Multi-model valuation reports designed for disciplined investors

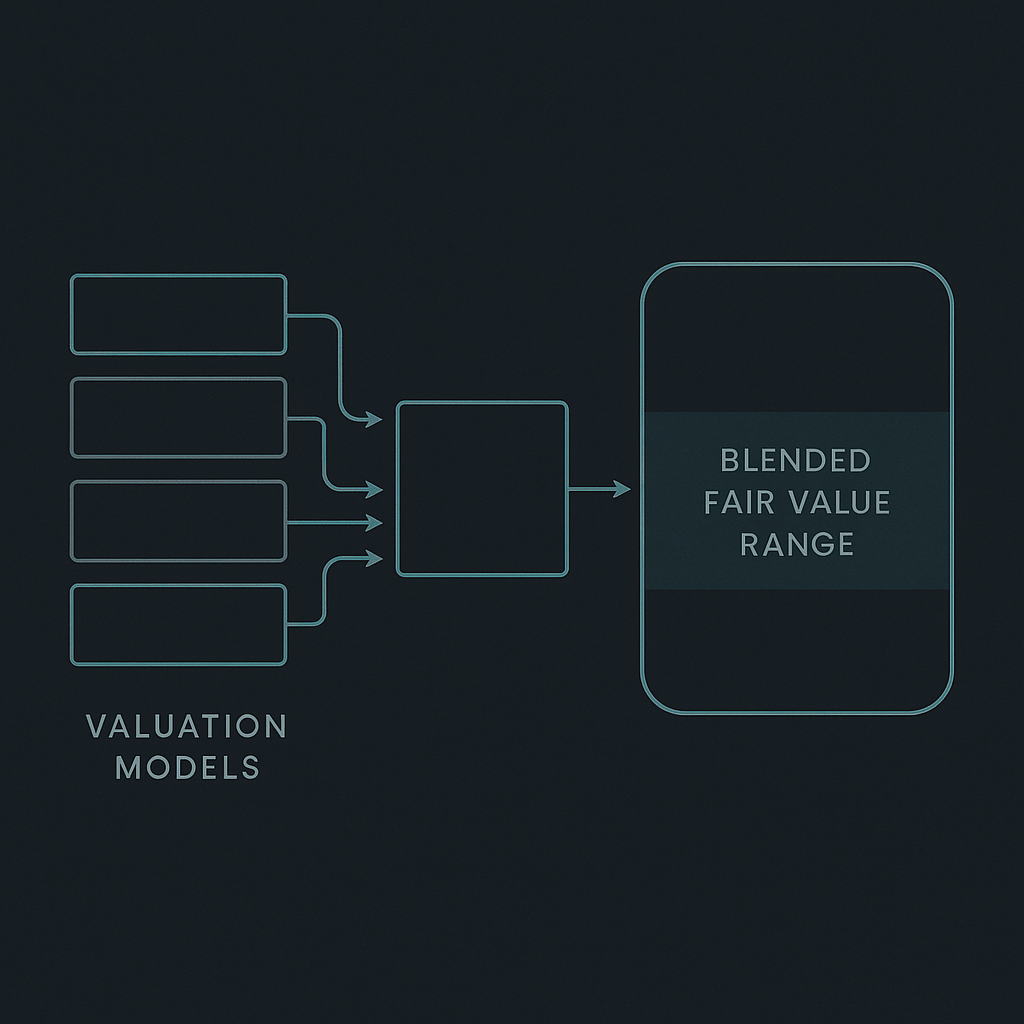

ValueMosaic aggregates several independent valuation models into a single, coherent assessment of a company’s worth.

Rather than relying on a single narrative or preferred framework, the system is explicitly designed to compare, reconcile and weight multiple perspectives within a consistent analytical structure.

Each report produces a transparent valuation range, clearly separating model inputs, assumptions and sensitivities — allowing investors to reason about value with clarity, discipline and repeatability .

What is ValueMosaic

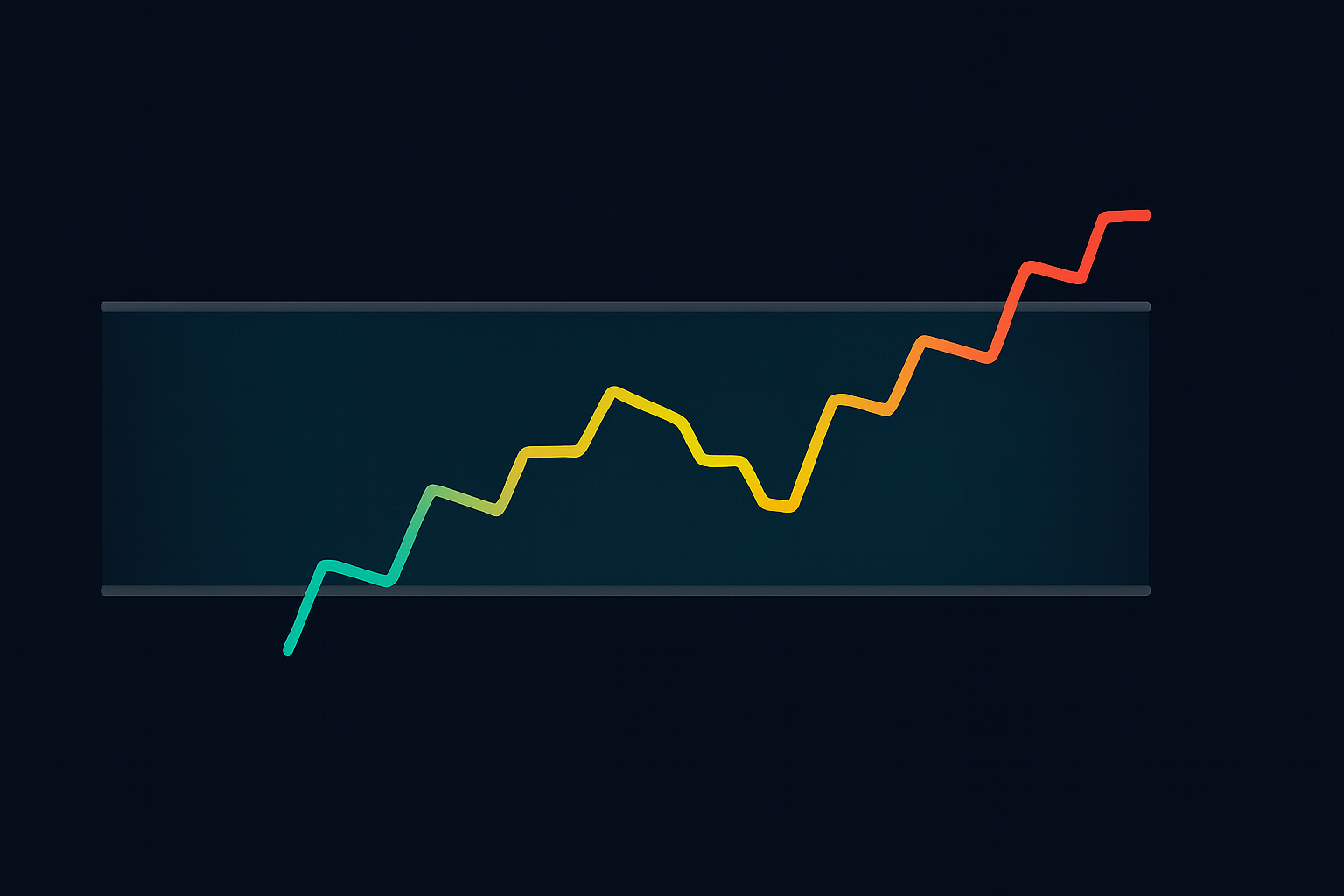

A growing library of model-driven equity valuation reports designed to support structured thinking about intrinsic value. Each report treats valuation as a range-based analytical problem, not a point estimate.

Why it works

Relying on a single valuation model introduces narrative and model risk. ValueMosaic reduces this by combining complementary frameworks, letting disagreement between models inform judgement rather than distort it.

How it works

Multiple valuation models run in parallel, filtered for robustness and aggregated using explicit weights. The result is a fair-value range reflecting both diversity and consistency.

Using the reports

Reports act as valuation anchors — supporting portfolio decisions, research workflows and comparative analysis without prescribing actions or timing.